Community energy fund consolidation

Low Carbon Hub is consolidating all shareholdings into the Community Energy Fund. All investments held in Solar 2014, Solar 2016, and Sandford Hydro will be transferred into the Community Energy Fund by 31 March 2025.

All investor members should have received an email from CEO Barbara Hammond with more detail about the consolidation and the potential changes this will have on your investment.

A forum to find out more

We held two webinars to give our investor members an opportunity to learn more and ask questions. These took place on 11 and 13 February.

FAQs

You may also find the answer to your question in our FAQs below.

How does the consolidation of portfolios help to deliver the ambitions of the Low Carbon Hub?

The consolidation enables us to manage our capital so that we can release larger amounts of community benefit earlier in the life of our portfolio.

When we started up in 2011, relatively little was known about the project life of renewable energy technologies and they were too expensive to pay a return without subsidies like the Feed-in Tariff. The subsidies were designed to enable projects to pay back over twenty years, and so we designed our Share Offers to match. We are now in a completely different environment, where the technologies have been proven and generally have a much longer life than the projected 20 years. Indeed, our two largest projects (Sandford Hydro and Ray Valley Solar) have leases for 40 years and financial models to match.

If we pay down third party loans and shareholder capital at the same time, the effect is to generate very large amounts of community benefit later in the life of our portfolio of projects and relatively less in the earlier years. As things stand, the majority of the community benefit would be generated after 2050 and so be unavailable to use when we need it now to help the transition before 2050.

We want to generate at least £800k of community benefit per year in the coming business plan period. Consolidating holdings into the Community Energy Fund will mean that we can raise new capital to match withdrawal requests and so have better control over cash flows to provide the sums of community benefit we need now.

What does your community benefit funding go towards?

Our installations produce an ongoing income, which is then reinvested in further carbon-cutting projects and supporting our network of nearly 50 community energy groups across Oxfordshire. Our new strategy sets out our focus for the next 10 years:

- Helping 23,000 households out of fuel poverty.

- Helping 57,000 households off oil for their heating.

- Helping over 18,000 SMEs to reduce their energy demand.

- Developing Community Action Plans for each primary substation area that can drive the transition to a zero-carbon energy system.

Each year we report on community benefit activity in our Annual Report and Accounts.

Is the interest rate different and will my interest payments change?

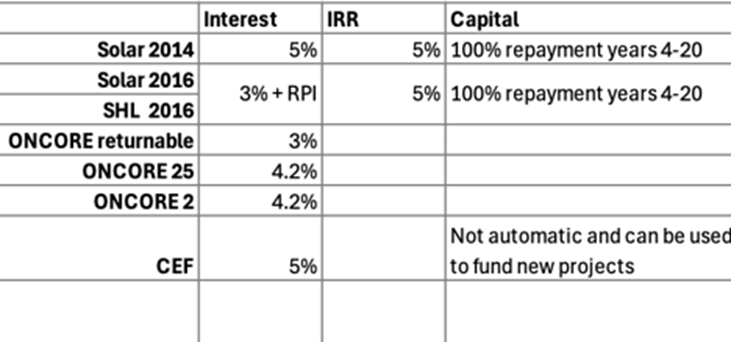

The table below details what each of the share offer documents said regarding target interest rates for each of the portfolios.

The Community Energy Fund has a target interest rate of 5%, which is different to some of the earlier portfolios. With this consolidation all investors will receive the same interest rate – a target of 5% – as everyone will be an investor in the Community Energy Fund.

By leaving capital in the Fund, investors will likely receive a higher rate of return (IRR) as you will be earning more interest than if your capital reduced automatically each year.

What happens to my capital repayments?

Investors in the Community Energy Fund do not automatically receive capital repayments, as the earlier portfolios did. Instead, there is an annual process for investors to request to withdraw their capital. You can see more about this withdrawal process in the Community Energy Fund Guidelines.

Can I withdraw my capital?

We strongly encourage investors to view their investments as a long-term commitment that generates long-term financial benefits to you and sustained environmental and social benefit to the community.

However, investors in the Community Energy Fund have the right to request their return of some, or all, of their capital. Although we cannot guarantee to fulfil all requests, we commit to making funding available each year to facilitate some requests.

Requests to withdraw capital will be met either out of ongoing project income or by raising new equity to replace it. Ultimately, equity withdrawal requests remain at the discretion of the Directors.

See the Community Energy Fund guidelines for more information on withdrawing capital.

How will I know what projects my money is going to be spent on?

We will report on the activity of the Community Energy Fund in our Annual Report and Accounts as well as ad hoc communications through our website and newsletters.

The Community Energy Fund is an open share offer, meaning that we will continue to raise investment into it, only pausing should we not have any need of the funds. We will keep the ‘Invest’ page on our website up to date with the latest investment needs and the projects the fund will be used to support.

Will this change affect the ONCORE shareholders that Low Carbon Hub took over?

Yes, investors in ONCORE will transfer to become investors in the Community Energy Fund. They will receive the interest rate for the Community Energy Fund. They will also no longer automatically receive their capital repayments but instead have the option to request to withdraw their capital in the annual cycle as laid out in the Community Energy Fund Guidelines.

Will Low Carbon Hub wait to raise more equity before agreeing to withdrawal requests?

We may wait to fulfil equity withdrawal requests until we raise the necessary equity to replace it through the Community Energy Fund. This is an open share offer in which people can invest at any time, as long as we have the need for such funds. This makes it much easier to raise capital as and when its needed, e.g. to replace capital withdrawn.

Will this change affect the Low Carbon Hub’s wholly owned subsidiaries? (Ray Valley Solar and Sandford Hydro Ltd).

No, they won’t be affected. We will continue to raise funds into the IPS through the Community Energy Fund. Any future large-scale projects like Ray Valley Solar or Sandford Hydro would also be held in a wholly owned subsidiary.

Will this change affect the membership of the community groups?

No, our low carbon community groups will continue to be members of the Low Carbon Hub IPS Limited with a £1 share.

Will this change affect the relationship with the Eynsham projects?

No, because there is already a separate agreement in place to share the profits from those projects. This agreement remains in place.

Will there be a vote on this change at the AGM?

No, we aren’t proposing a substantial change to our governance that would require a vote at the AGM. The share portfolios being consolidated, and the Community Energy Fund itself, are all contained within a single share class. The change is therefore about the management of that single share class and Directors have the powers to make such a change.

Will I start earning 5% interest immediately on transfer?

Yes, shareholdings that are moving into the Community Energy Fund as part of this consolidation will start earning the target interest rate of 5% immediately. They won’t have to wait for their investment to be in the Fund for a minimum of four years, unlike new shareholdings in the Fund.

You can also contact us directly on members@lowcarbonhub.org if you have any questions not covered here.